Newly Constructed Dwelling Unit Property Tax Credit Due to Expire on June 30, 2019

April 17, 2019 | Justin Williams, Land Use and Zoning Attorney

Expiring opportunity to obtain significant reductions in property taxes for newly constructed or substantially rehabilitated homes in Baltimore City

Time is running out for buyers of newly constructed homes to obtain a significant reduction on property taxes in Baltimore City.

Since 1996, buyers of newly constructed homes in Baltimore City have been eligible for a substantial tax credit intended to ease the burden of being subjected to property tax rate that is highest in the state and twice that of neighboring Baltimore County. The tax credit, named “Newly Constructed Dwelling Tax Credit” (NCDTC), is a five-year City real property tax credit (50% in the first taxable year and declining by 10 percentage points thereafter) on newly constructed or substantially rehabilitated dwellings if the property has not been previously occupied by owner or tenant since its construction or rehabilitation.

The State law authorizing the City to grant the tax credit contains a sunset provision pursuant to which it will expire on June 30, 2019. The law has been set to expire a handful of times since 1996, however, in the 2019 Session that just ended on April 8th, the General Assembly did not move to extend the law.

Under the terms of the State law, the expiration of the NCDTC will not impact those eligible owners who already obtained the credit, as they will be able to receive all five years of the NCDTC. However, recent purchasers of eligible homes, as well as people contemplating buying—or who are under contract to buy—eligible homes will be impacted as the sunset provision mandates that new NCDTC credits “may not be granted” after June 30, 2019. Even if an NCDTC application were submitted in advance of June 30th, the City Department of Finance’s regulations specify that it will not “provide credit approval” until after it receives the new tax assessment notice from the State Department of Assessments and Taxation (SDAT). The problem is that it may take weeks or months for SDAT to perform the reassessment of these newly constructed or substantially rehabilitated homes. For example, if the buyer of a newly constructed home went to closing on May 1, 2019 and submitted an NCDTC application the same day, if SDAT has not reassessed the value of the home by June 30, 2019 it appears that the credit would not have been deemed to be “granted” by the deadline.

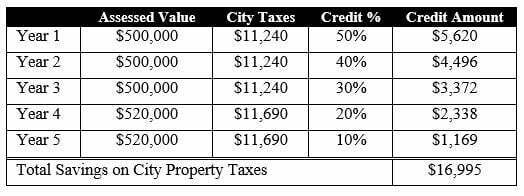

The impact of the expiration of the NCDTC can be substantial for purchasers of eligible homes. For example, the table below shows that the tax credits that would be available to the purchaser of a newly constructed home that is first assessed by SDAT for $500,000 and then reassessed to $520,000 after 3 years. The total property taxes saved over a 5-year period would be $16,995.

The Land Use and Zoning attorneys at Rosenberg Martin Greenberg, LLP are closely monitoring the Newly Constructed Dwelling Tax Credit. We encourage you to reach out to us if we can be of assistance in any way. Contact Justin Williams at 410-727-6600 or email jwilliams@rosenbergmartin.com.